- #Web

- #Fintech

- #Cloud

Serenity

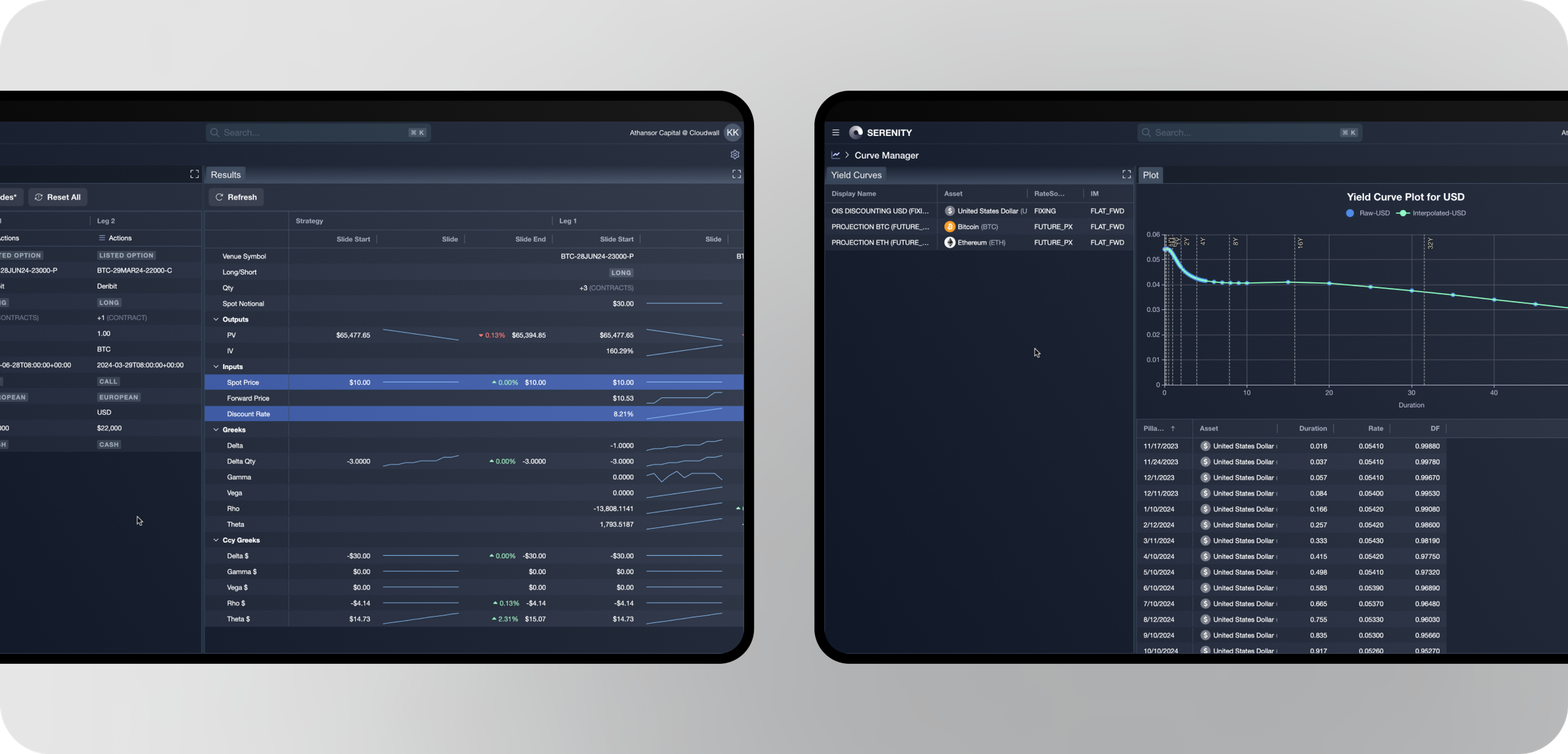

Cloud-based digital asset risk platform for a financial services company

Business results

01

With the cutting-edge digital asset risk solution, the client raised $6.3 million in seed funding🔥. The UI/UX design was featured by stakeholders as of the highest quality, especially for an early-stage startup.

02

In 3 months, the company received an MVP—Alpha product version with connected APIs—and gathered user feedback for further system evolution. Using the MVP, the startup was able to attract 3 institutional investment funds and 11 prop traders. In the course of 2 years, the MVP has been transformed to a fully-fledged portfolio risk platform for cryptocurrency and digital assets with many satisfied users.

03

Thanks to a corporate website, landing pages, and logo developed by our team, the customer created a strong brand identity and increased awareness.

Clientabout us

“Aligned Code's clean and sophisticated design work has helped the client raise venture capital funding for their product. Flexible and adaptable, the team delivers on time and is responsive to the client's needs. Their top-notch design expertise allows them to bring immense value to the table.

We saw zero issues and all deliveries were on time or ahead of schedule. Bear in mind though that this was a fully-remote, embedded type arrangement rather than outsourced PM+tech; the success here was that they merged into the team seamlessly.”

About the project

A fintech startup came to Aligned Code to deliver a cloud-based platform that would provide investors with actionable risk, correlation, and other data insights to create portfolios and trade digital assets confidently.

Client

Founded in May 2021, the client is a financial services startup. Headquartered in New York, US, the company also has an office in Singapore. The customer has a flagship cloud-based fintech platform—developed in cooperation with Aligned Code—to help institutional investors create portfolios, evaluate risks, and trade with conviction.

Operating in the financial industry, the client recognized that investment portfolio management tends to have various risks associated with market correlation, volatility, etc. Institutional investors often did not have sufficient, real time data to make informed decisions and put money into assets effectively.

Project goal

Aiming to address the problem, the customer wanted to combine risk management with research to enable institutional-grade investors to obtain the overview of their assets. The idea was to let users access historical data from numerous sources, including centralized exchanges and blockchain to analyze and demystify the digital/crypto asset market.

In this regard, the company decided to build a cloud-based platform that would provide investors with risk, correlation, and other actionable insights to create portfolios and invest confidently. It was also important to allow investors to run simulations and stress tests to see how their portfolios would behave under different circumstances.

However, the startup did not have expertise in UI/UX design of comprehensive fintech system interfaces. In addition, the company needed to create a website and landing pages. Furthermore, the client was looking to hire frontend engineers to deliver the product under tight deadlines and demonstrate it to stakeholders.

The customer came to us by referral: another business advised Aligned Code as a reliable provider of fintech software development services. After project discussion, the startup partnered with Aligned Code, taking into account aspects like great culture fit, good value for cost, and close geographic location.

Since the company was excited about the design delivered by our UI/UX team, it decided to delegate to us frontend development, too.

Solution

Our team began by analyzing client goals and requirements. After getting a clear project understanding, we outlined a solution delivery roadmap and drew wireframes.

Then, we proceeded to platform UI/UX design and development. Our experts also created the company’s logo and unique branding style. On top of that, we built a corporate website. Following Agile best practices, our software engineers showcased intermediate results every 1–3 weeks.

The challenges we solved:

- Since the fintech solution was intended to give institutional investors access to the most actual data to manage assets, providing real-time updates was vital.

Our fintech developers used Pub/Sub and Redis to implement real-time data updates, allowing investors to subscribe to various data parsing channels. The system parses numerous financial indicators from paid and free sources to enrich and train risk prediction models. Notifications and messages from those channels are then forwarded to all subscribed users.

What’s more, we created exclusive user interface scenarios for data visualization to ensure a better user experience across multiple screens and browsers. - As the platform would retrieve massive arrays of data from numerous sources, it was essential to prevent overfetching (when the system processes more data than actually needed, which may lead to performance issues) and underfetching (when the system has to make multiple API calls to get all the required data).

To resolve the problem, our engineers set up efficient client-side asynchronous state management and data fetching. We utilized React Query to handle cache invalidation and background updates. Using the tool, our team tweaked client-side caching instead of making new API calls. - With large data amounts from a number of sources, it was crucial to enable efficient data processing.

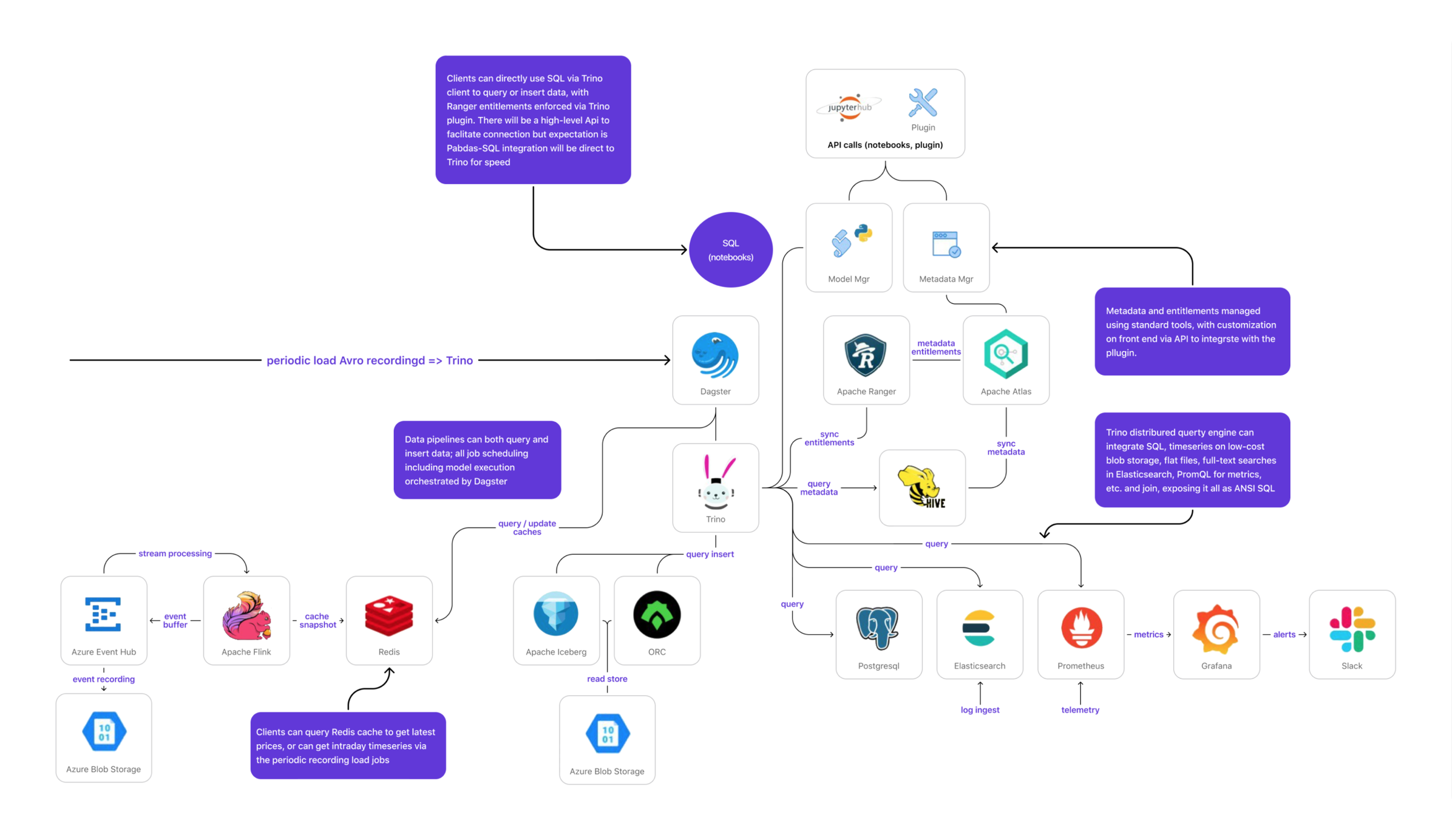

The developers built the system architecture—you can see it on the picture above—with a data lake storing two types of data: batched and real-time.

- Python was used to process batched data and create quantitative models. Those models query and process data, inserting it back into the Trino engine.

- Using Dagster, data pipelines were set up while the data from them is written to the Trino query engine.

- Real-time data such as prices and trades is processed employing real-time Java streaming and then written to Redis, so that services (sources with real-time financial and currency data) can subscribe to it.

- DevOps best practices were implemented to automate the development process. The data monitoring stack was applied using Prometheus, Elasticsearch, and Grafana.

To achieve smooth product operation, our QA professionals used various types of testing. Special attention was paid to the UI side where our team created unit tests with Vitest and end-to-end tests—using Playwright.

By focusing on e2e testing and writing unit tests when required, we examined how users would interact with the product while saving time and effort on manual testing.Those tests gave us boundaries, so when something is broken (intentionally or unintentionally), our experts have observability over it. We also utilize end-to-end tests to test the main functionality.

Finally, we delivered the fintech solution that perfectly fits the needs of:

- Hedge funds. Crypto hedge funds can use the product to manage diverse portfolios of digital assets. The system offers institutional-grade risk models and portfolio analytics required to get a clear understanding of portfolio's risks and performance.

- Prop traders. Prop trading firms can utilize the application to elaborate and implement their investment strategies. The platform provides specific models for digital asset risk management.

- Family offices. The system allows family offices to invest in cryptocurrencies indirectly, for example, via funds or separately managed accounts.

During the project, we established seamless cooperation with our client through transparent communication, reporting, and continuous support. We performed weekly demos, regular meetings, and C-level synchronizations to showcase intermediate results and discuss the necessary issues.

For remote collaboration, our team utilized Slack, Google Meet, and Zoom. It is worth noting that we provided our customer with access to the project management system to monitor project progress and time spent on tasks.

Key features

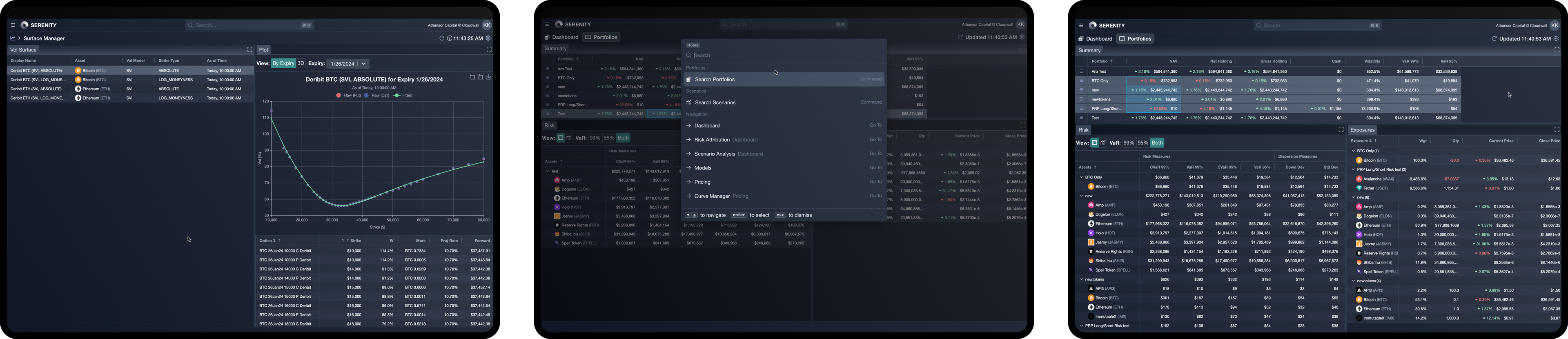

We delivered a cloud-based portfolio risk platform that allows institutional investors to run a variety of risk models and obtain a clear view of their assets.

- Data visualization dashboard with various widgets

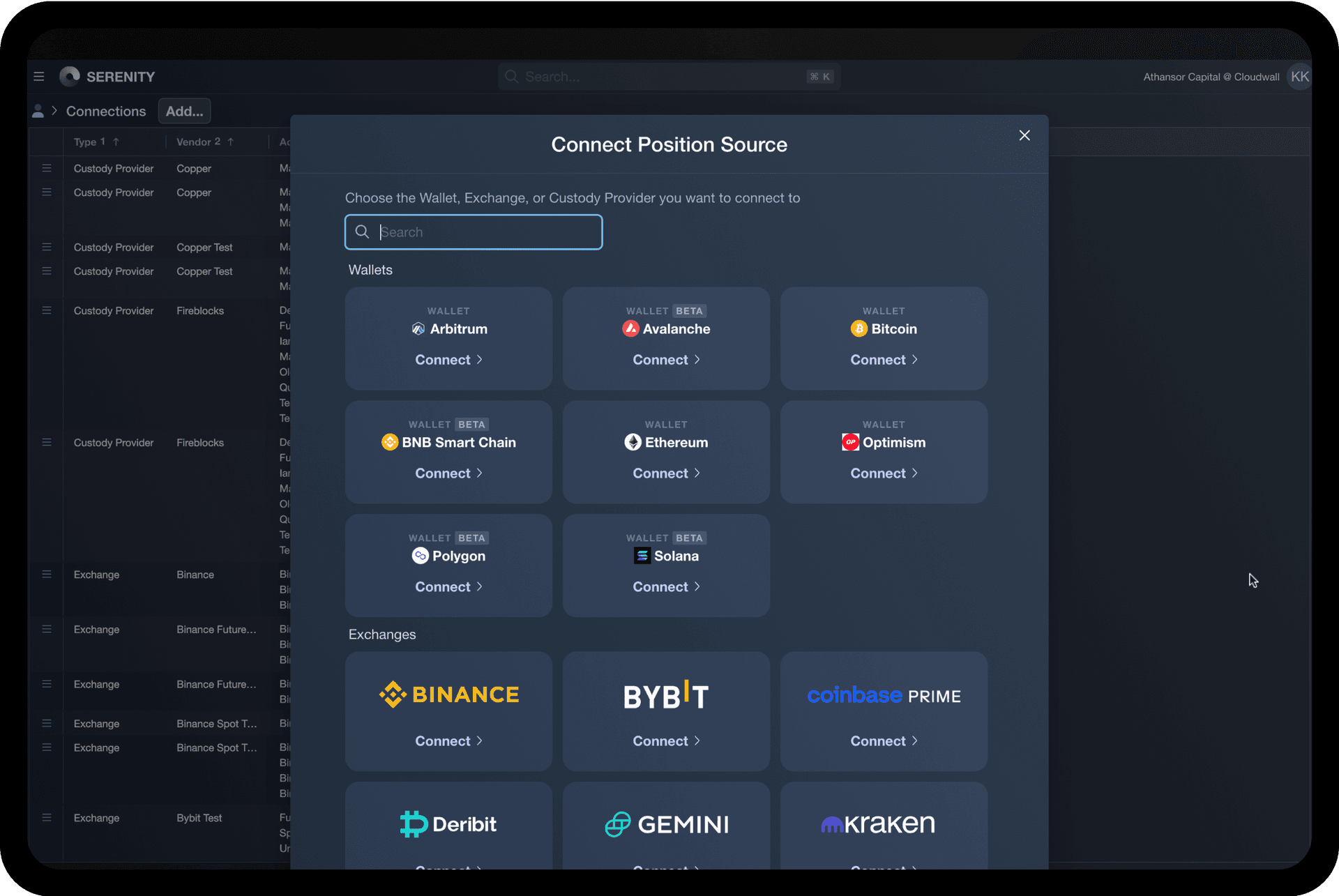

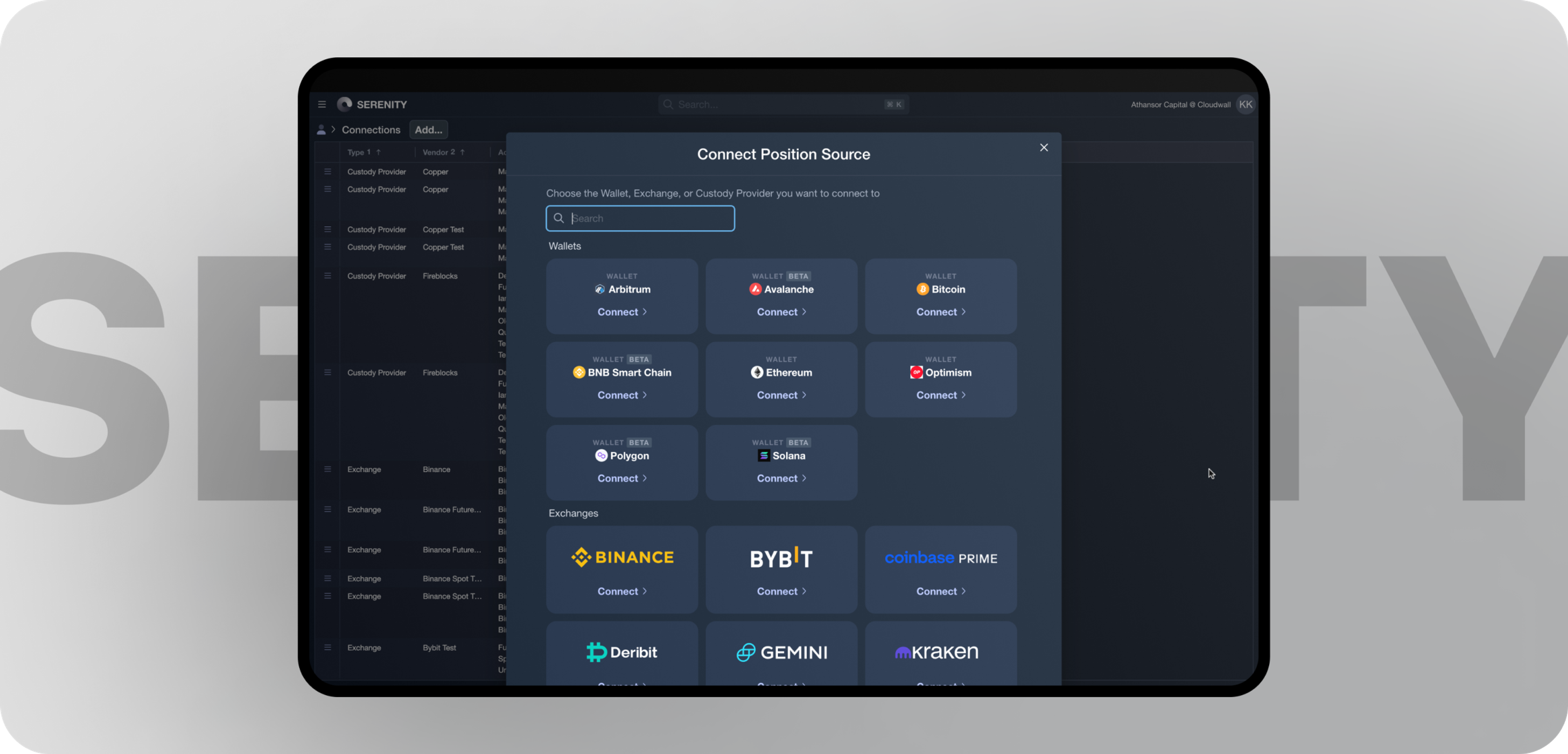

- Connections with wallets, exchanges, and custody providers

- Scenario analysis with support of predefined and custom scenarios

- Risk attribution with matrices

- Exposures and breakdown views

- Multi-leg listed/OTC option pricer

- Machine learning-powered scenario analysis with support of predefined and custom scenarios

- Volatility Surface and Yield curve managers

- User management

- App-wide search menu

Our team also created a corporate website and company branding style.

Timeline

Two years, ongoing

Team

Aligned Code

a UX designer, 2 frontend developers, a project manager

Client

a product owner, a frontend developer, a backend developer, a CTO

Tech stack

Website

Gatsby, Sanity, TypeScript, styled-components.

Frontend

TypeScript, Remix, React, React Query, Prisma, Chakra UI, AG Grid, ECharts, Lodash, React Hook Form, Yup, Playwright, Vitest.

Backend

Python, Java, Pub/Sub, Apache Flink, Redis, Auth0, PostgreSQL.

Infrastructure

Elasticsearch, Grafana, Prometheus, Docker, Kubernetes, Kong Gateway, Argo CD, Terraform, Trino, Dagster, Ansible.

Platform

Amazon Web Services.

Results

Thanks to the product design created by our team, the client successfully raised venture capital funding. The design of the fintech solution was featured by users and client’s investors as of the highest quality.

In 3 months, the company launched an MVP—Alpha version with connected APIs—and gathered user feedback, playing an important role for the further system evolution. With the MVP, the startup was able to attract 3 institutional investment funds and 11 prop traders while providing fast effective onboarding.

To date, the MVP has been transformed to a fully-fledged portfolio risk management platform for cryptocurrency and digital assets.

At the moment, the company continues scaling the system. For example, now our priority is to enable investors to work with a multiple prop-traders account within a single fund. Another task is to move from pull/push to real-time risk management.

Get a free consultation from our IT experts! Contact us

Get a free consultation from our IT experts! Contact us

Fresh updates

- #Web development

Find out how we received a lead generation channel and a lot of cool projects with a new branded website. In fact, the number of organic leads increased by 6x in just a month!🚀

- #Development

- #Trends

Get the list of the best custom software development companies, including aspects like solution/domain/tech expertise, hourly rates, and office locations. Find your IT partner!🎯

- #Development

- #Trends

When should you hire IT consultants? How can IT consulting experts help you save costs and increase project success chances? Find out the answers!✅

Contact us